Option Holder Class Action

In this matter, our firm represented current and former employees who had been granted stock options in a publicly-traded company under an employee option plan. That option plan provided that if there were ever a “change in control” of the company (such as a merger or other acquisition), the employee options would become immediately exercisable and would remain exercisable until the expiration of their stated terms.

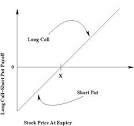

In 2006, the company was taken private in a cash out merger. For those options that were “in the money” (that is, the option strike price was less than the agreed upon per share cash purchase price ), the company paid the difference to the option holder; for those who held “out of the money” options (where the strike price was greater than the agreed upon per share cash purchase price), the company unilaterally canceled the options.

Relying on Delaware law, our clients brought an action for breach of contract, procurement of breach of contract and conversion on the grounds that the options were unlawfully canceled and that the options still had economic value regardless of being out of the money at the time of cancellation because they still had unexpired terms on the date of cancellation. The company argued that even if the cancellation had been improper, the options had now expired by the time suit had been filed and that given the stock market crash of 2008, the options would never have gone into the money. Despite this argument, we were able to secure a settlement of approximately $1 million for the class.